Canada needs CAD 65 billion mining investment to meet demand: study

Canada needs to increase investment in critical minerals by CAD 65 billion ($48 billion) to meet expected growth in both domestic and global demand, a new study finds.

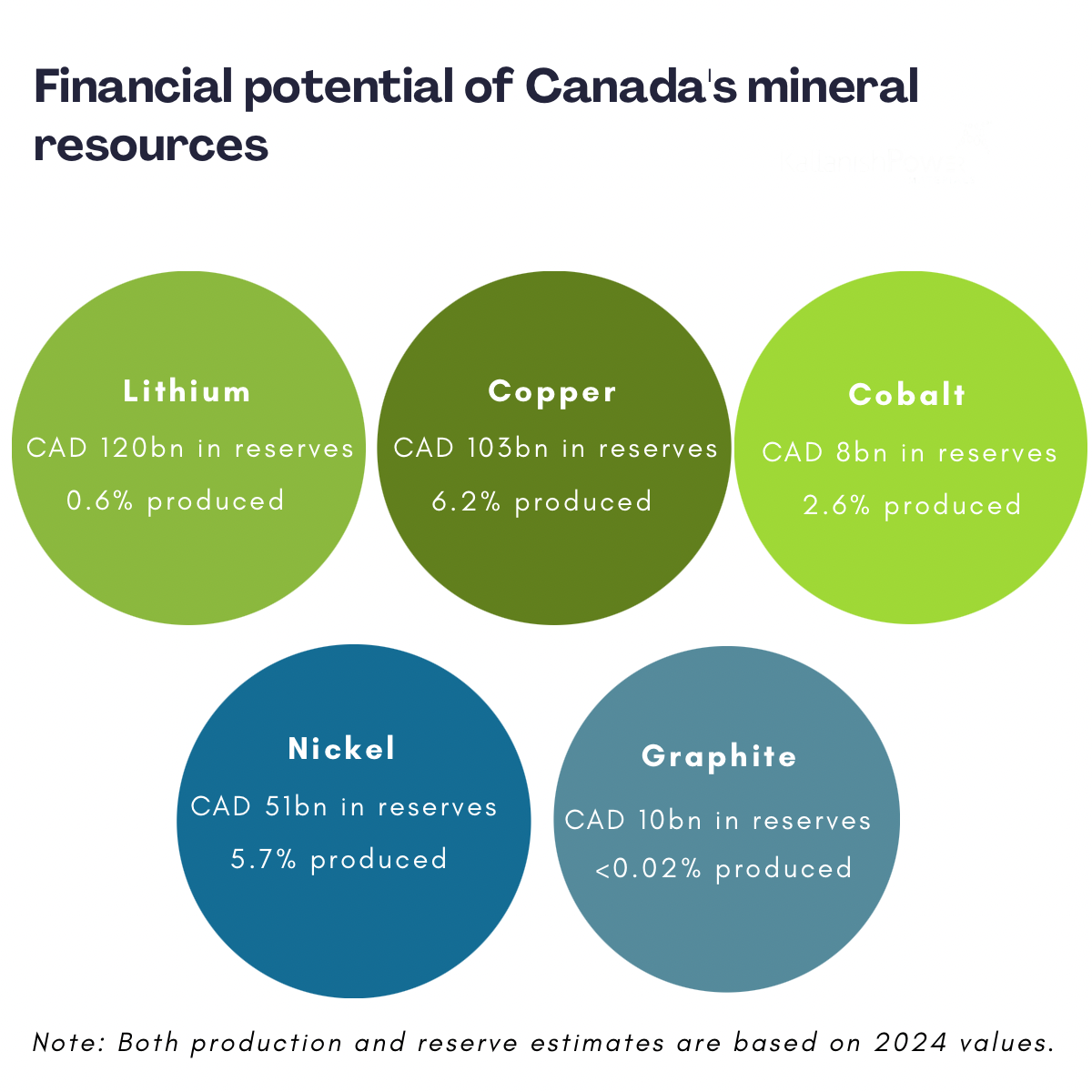

According to the Canadian Climate Institute, the country should open more than 30 new mines of six priority minerals – copper, nickel, lithium, graphite, cobalt, and rare earth elements – between now and 2040. Upstream investment of CAD 30 billion would be enough to meet domestic demand, rising to CAD 65 billion to produce enough to export.

If mining output does not ramp up, Canada would miss out on a CAD 12 billion opportunity from domestic industry alone, researchers warn.

Yet, investor confidence in the critical minerals space has been wavering amid persistent price volatility, Kallanish writes. The Canadian Climate Institute argues that governments can help build certainty by sharing risks through targeted policies and programmes, such as equity investments, offtake agreements, or contracts for difference.

“As competition heats up and trade relationships evolve, Canadian governments should make haste to adopt policies to unlock private investment and bring resources to market faster – all while forming respectful partnerships with Indigenous communities and reducing environmental risks,” comments Rick Smith, president of the institute.

Currently, Canada is the world’s fifth-largest producer of cobalt and nickel, sixth for lithium, seventh for graphite, thirteenth for copper, and has yet to begin rare earth mining at a commercial scale, according to the US Geological Survey. China dominates the supply chain of all battery minerals.

Source: Canadian Climate Institute

Truly global, user-friendly coverage of the steel and related markets and industry that delivers the essential information quickly while delivering on most occasions just the right amount of between-the-lines comment and interpretation for a near real time news service of this kind.

Anonymous

Very good overview of the weekly steel market.

Anonymous